Fellow humans,

Nonstop learning and adapting is the key to growth in any field. Just because we’ve reached some higher level of success as investors, doesn’t mean we should stop revisiting the basics and evaluating ourselves to make adjustments.

Occasionally, I like to consider all the lessons learned over the years while simultaneously approaching my portfolio strategy with fresh eyes. In other words, I like to start from scratch while applying my knowledge and experience.

One thing is for sure—we should have a significant stash of bitcoin in cold storage that we treat as an off-limits type of emergency fund. The exact amount will be unique to each of us, so I can’t decide the exact number for you, but I will say that bitcoin could be a substantial percentage of your overall net worth, and that would most likely pay off handsomely over the next 5-10 years.

My bitcoin position is currently around 10% of my net worth. This number is small for me, but that’s because I’m in the midst of a position-trade with the intent to build my bitcoin stack. If the market swings in my favor, I’d like to close the trade. Afterwards, my number would be around 50% for the long-term. Some may call this gambling, but it’s worked for me before, so I call it calculated risk.

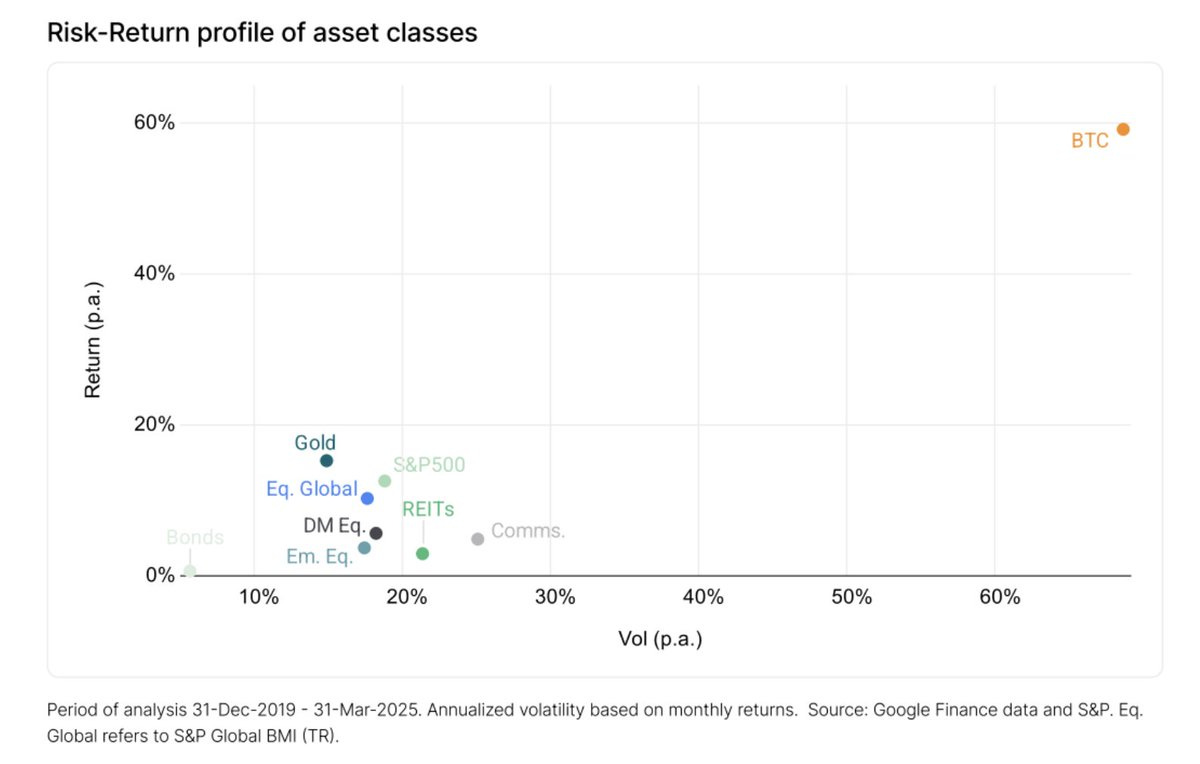

Why should we hold so much bitcoin? Because as far as major investable assets are concerned, bitcoin has the least amount of risk with the highest probability for growth. In other words, bitcoin has the most attractive risk-return profile.

“The holy grail of investing is to find asymmetric assets that present a more attractive risk-reward trade-off than other opportunities.” -Anthony Pompliano in The Pomp Letter on July 10, 2025

Do you see bitcoin in the top right corner? Yeah, a class of its own.

If you don’t quite understand what this means, then you might want to take some time to learn, because many other economic mysteries will start making sense once you realize why bitcoin is such a uniquely important asset.

Other than holding a solid chunk of bitcoin for the long-term, the rest of our portfolio should be selected based on our interests and conviction. I was not always in alignment with this view, as some of you know from past articles of SALtoshi Whitepaper. I used to think that bitcoin is the only asset we should hold, and everything else is a scam, which some people still believe.

I’m not saying a portfolio made of 100% bitcoin would be wrong. In fact, this strategy can be very helpful because it’s simple and proven to be effective. However, we all may have our own reasons for wanting to hold different stocks and crypto, and it’s our money so we should do whatever we want.

To use a metaphor—choosing assets for our portfolio is like being a contractor and adding/removing different tools within our toolbox. Diversification can be very effective if done with precision. Sometimes bitcoin is going down in price while other assets are going up. This is when diversification is most helpful.

I’ll give an example of how diversification can be counterproductive though. Imagine holding 10 different stocks and 10 different crypto assets, but in the end, all of them have grown 10% per year. The S&P 500 grows about 10% per year, so you had to track and manage 20 different assets, when you could have allocated 100% of your portfolio to SPY 0.00%↑ and reached the same exact outcome.

The bottom line is to avoid diversification when it complicates your strategy, and embrace it when it compliments your strategy.

Tying all of this information together and putting things into motion, many people still may not have found a reliable investment platform to buy, sell and hold their assets, and I may have a beneficial answer for this open question.

Again, some bitcoin should be held in offline storage, so exclude this for the moment. Other assets, such as stocks and altcoins can be bought, sold and stored in a trusted exchange for convenience and quick access. You can think of this strategy like a savings account on steroids that you’re constantly building and managing. Money that grows and that you have access to spend, if needed.

My sister recently recommended Kraken, so I’ve been building a portfolio here since last month. This U.S. exchange was founded in 2011. They’ve survived and strived during many market cycles and major challenges in the crypto industry, so they’ve proven to be one of the more trustworthy exchanges in the world.

However, according to Wikipedia, “The company has been the subject of several regulatory investigations since 2018, and has agreed to cumulative fines of over $30 million.” I’m not saying this should be a huge concern for investors, because it’s not like the exchange was hacked, which is probably the #1 concern when considering exchanges. All I’m saying—don’t be naive enough to think that your money is 100% safe when somebody else (including banks) is holding it for you.

To summarize, I like Kraken because they’re based in the United States, have been around for 14 years with a strong enough track record of protecting customer funds, and I can trade and store bitcoin, various altcoins, and stocks—all in the same account. I would highly recommend for anyone.

Until next time,

Salvatore Norge

P.S. — Years ago, I recommended BlockFi, and they’ve since gone bankrupt, so never trust my word completely and always be responsible with your money.

“Keep falsehood and lies far from me; give me neither poverty nor riches, but give me only my daily bread. Otherwise, I may have too much and disown you and say, ‘Who is the Lord?’ Or I may become poor and steal, and so dishonor the name of my God.” PROVERBS 30:8-9

I am not very wise. Never financial advice. Do your research!