Chips on the Table

SALtoshi Whitepaper #177

Fellow humans,

You might be tempted to trade your bitcoin for dollars. You might feel the need to quit while you are ahead. You might even wonder if bitcoin is going to zero, and this is why humans should not be in charge of monetary policy. This is why fiat currencies (money printers) should be wiped from existence. This is why we should either devolve back to gold or evolve forward into a bitcoin standard.

We are impulsive, emotional and irrational beings who often make short-term decisions without considering long-term consequences. Central banks have been stealing economic value from future generations via inflation in order to preserve the old system. Kicking the can down the road is their greatest skill.

What we need to do — the opposite of central bankers, which means do not be impulsive, do not act on negative emotions, and always consider long-term consequences when making decisions. Obviously we have zero control over US monetary policy, but we do have control over our own financial assets.

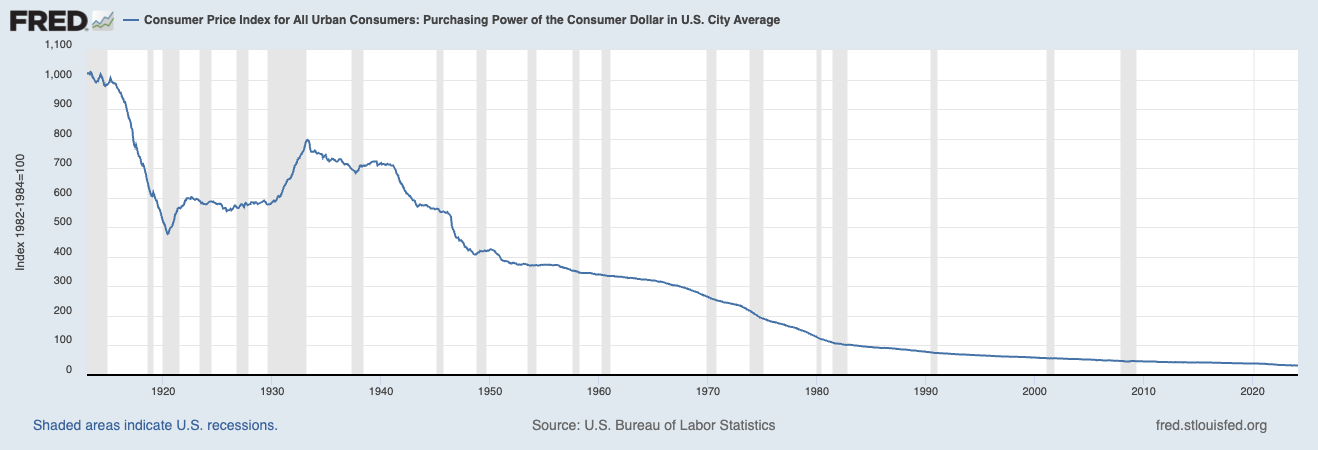

Make no mistake, the dollar is trending towards zero. Even our own government (Federal Reserve Bank of St. Louis) is showing us the truth. You cannot look at the following chart and come to any other conclusion. For the past 111 years, the purchasing power of the US dollar has been stripped to almost nothing at the hands of reckless monetary policy. Do you see a way to reverse the trend?

There are many financial assets (investments) one should hold while the dollar slides towards zero. The beautiful thing about being an American is that we have the freedom to choose (for the most part) which investments we hold. America has not always offered financial freedom though.

I do not mean to be insensitive, but grown men have done far less prison time for raping children. Society is backwards. We should do all we can to address and resolve the fundamental issues. In the case of money, we should phase government money out of our lives as much as possible.

Savings accounts are scams, credit scores are outdated, and too much debt creates economic slavery. Nobody should have the capabilities of creating money out of thin air. Everybody should be required to work for money, but we all know how life works. Society is backwards.

Americans have freedom, but freedom is meaningless without proper orientation. Although all Americans have limitless opportunities to pursue the career of their choice, then become successful investors from the comfort of their homes, only 61% of American adults are invested in the stock market, and far less (20-40%) hold bitcoin/crypto.

You may look at these numbers and your initial reaction may be that a lot of people are investors. Yes, six out of ten people is majority (barely), but why not everyone? Out of the 61% invested in the stock market, how many are earning enough gains to have a material impact on their lives?

I do not know the answers, but my assumption is that a majority of the 61% are waiting for retirement or an emergency to utilize their gains. I believe most of the 61% are still living paycheck to paycheck and swamped in debt.

Everyone with an internet connection should pursue the path of an investor.

Financial markets are driven by human psychology and emotion. The data represents the consequences of human behavior. When people are greedy, numbers go up. When people are afraid, numbers go down. When people are indecisive, numbers go sideways.

I was wrong about the bitcoin halving (price prediction), which occurred last Friday, when the new incoming supply of bitcoin decreased from 6.25 per block to 3.125 per block. The annual inflation rate of bitcoin was reduced by 50% from ~1.7% to ~0.83% for the next 210,000 blocks or roughly 4 years.

The price of bitcoin was around $65k on the day of the halving, not $40k, so I will not try to predict the price at this point. However, I am still in the business of predicting the direction of the price. Needless to say, I was 100% correct on the direction of the price (the odds are 50/50), but I was not bullish enough.

First, I need to make something clear. The most recent halving was the first halving in the history of bitcoin when we saw a new all-time high prior to the halving. Some people in the industry predicted this, but I was not convinced.

What does this mean for the near future of price action? It must be bullish, right?

Right??

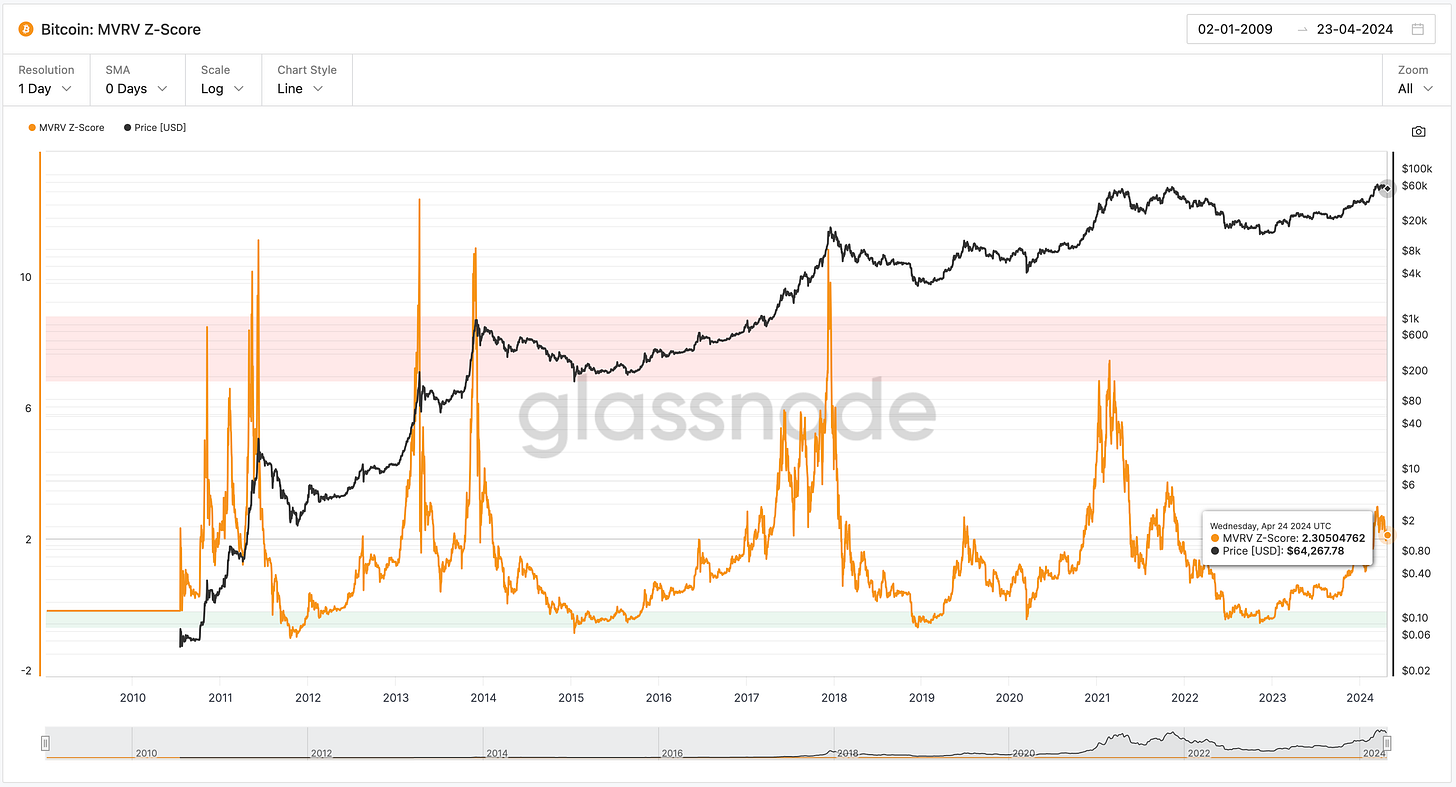

The following chart has data from 2010 until yesterday, and shows the price of bitcoin (black) and the MVRV Z-Score (orange), with red and green zones. Historically, when the MVRV Z-Score reaches 7 (red zone), that means bitcoin is “overvalued” or overbought, which signals caution to buyers.

Buying in the red zone has usually been accompanied with buyers remorse, because long bear markets have always followed (eventually). On the other hand, buying in the green zone has usually been accompanied by celebrations to the song BITCOIN PUMP IT UP and Lamborghinis, for obvious reasons.

As you can see, the market is relatively cool right now, with an MVRV Z-Score of only 2.3, which means bitcoin is technically near the “undervalued” AKA discounted zone. In fact, we are only 33% or 1/3 of the way towards the red zone.

Do not become obsessed with data though. Historically, we were not scheduled to reach an all-time high before the halving, but we did. You can also see the MVRV Z-Score exploding above the red zones to 12.5 in 2013, and 11 in 2017.

Unexpected things happen. Bitcoin does not exist independent of world events. Yes, the monetary policy of Bitcoin is unaffected by world events, but the market reacts to war, elections, fiat currency inflation, crypto corruption, Elon Musk, etc.

We use these data as guidance to roughly predict the future, not place our bets with 100% conviction. With all of this being said and understood, the near future of bitcoin’s price action looks very positive with much room to grow. I will not be selling anytime soon, if ever.

I will be following many things to determine my trades, especially the MVRV Z-Score, which is possibly the most popular data point for market analysts. Additionally, logic and intuition have been very helpful for me. Thinking for myself and analyzing data on my own terms has been invaluable.

Prior bull markets have been extremely aggressive with euphoric explosions in price action, with everybody and their Grandmother not only talking about bitcoin and crypto, but also buying. None of this has happened yet. Remember, financial markets are driven by human psychology and emotion.

You do not necessarily need to check the MVRV Z-Score to know when bitcoin is overbought. Simply open your eyes and ears, and society will give the signal. Right now, people are quiet and disinterested. The hype is still in its infancy.

My goal is to buy from weak markets and sell into strong markets. The current bull market has been strong since January 2023, but not strong enough for my taste. I think I will stick around for a while, and keep my chips on the table.

Until next time,

Sal Norge

P.S. — Do not be like my friend Skeptical Dave.

“Keep falsehood and lies far from me; give me neither poverty nor riches, but give me only my daily bread. Otherwise, I may have too much and disown you and say, ‘Who is the Lord?’ Or I may become poor and steal, and so dishonor the name of my God.” PROVERBS 30:8-9

I am not very wise. Never financial advice. Do your research!